The rate of tax to be used is the rate which is applicable on such goodsservice. If it is not possible to determine the time of supply under a b or c above the time of supply.

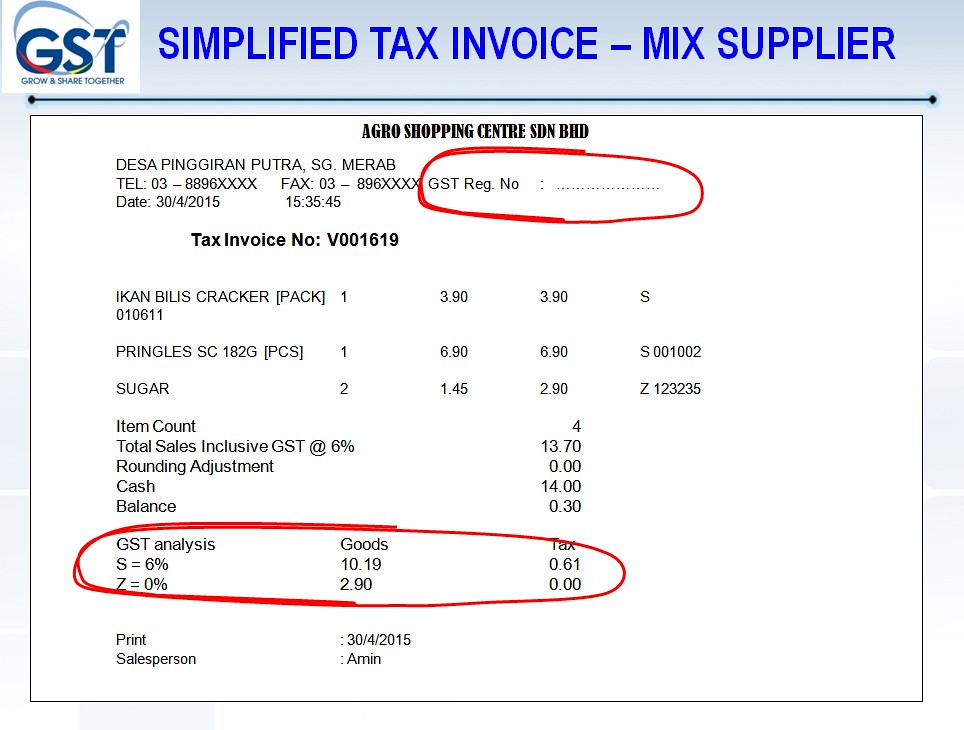

Gst Malaysia Simplified Tax Invoice Mix Supplier Gst Malay Flickr

Penalty 100 of the tax due or Rs.

. Get link to copy the invoice link. Proforma Invoice Template. The date immediately after 30 days from the date of issue of invoice by the supplier.

John can claim a GST credit of 100 on his activity statement. Every tax invoice you get or issue must show this standard information. For invoices and sales credit notes you may need to reissue the invoice or credit note to your customer.

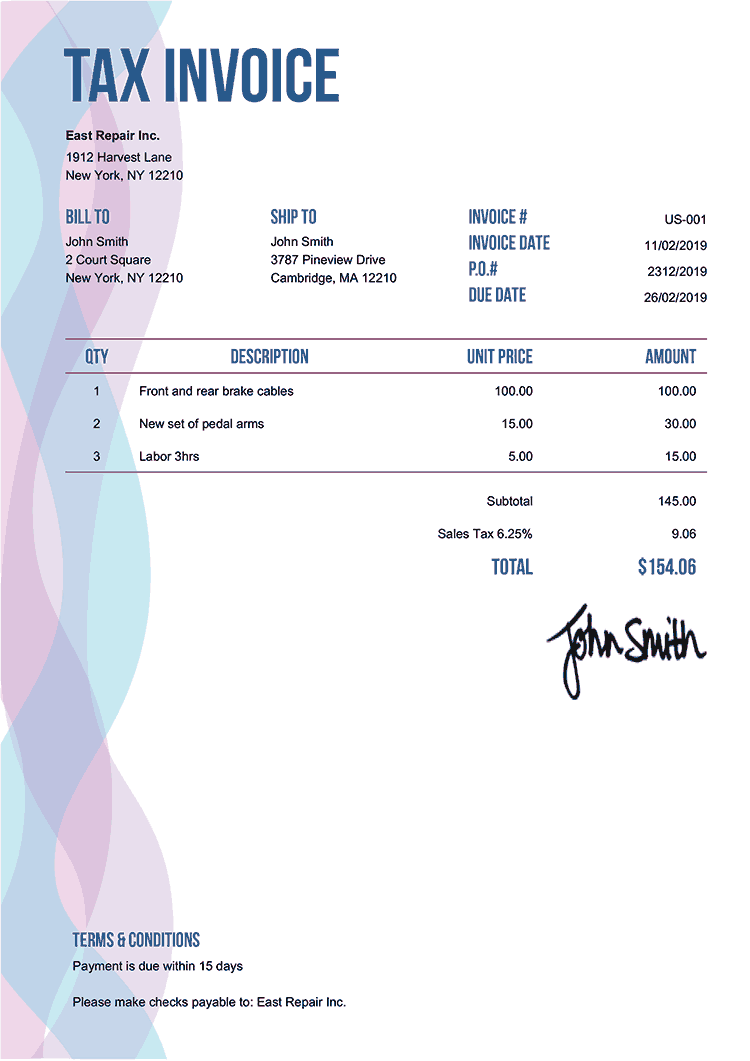

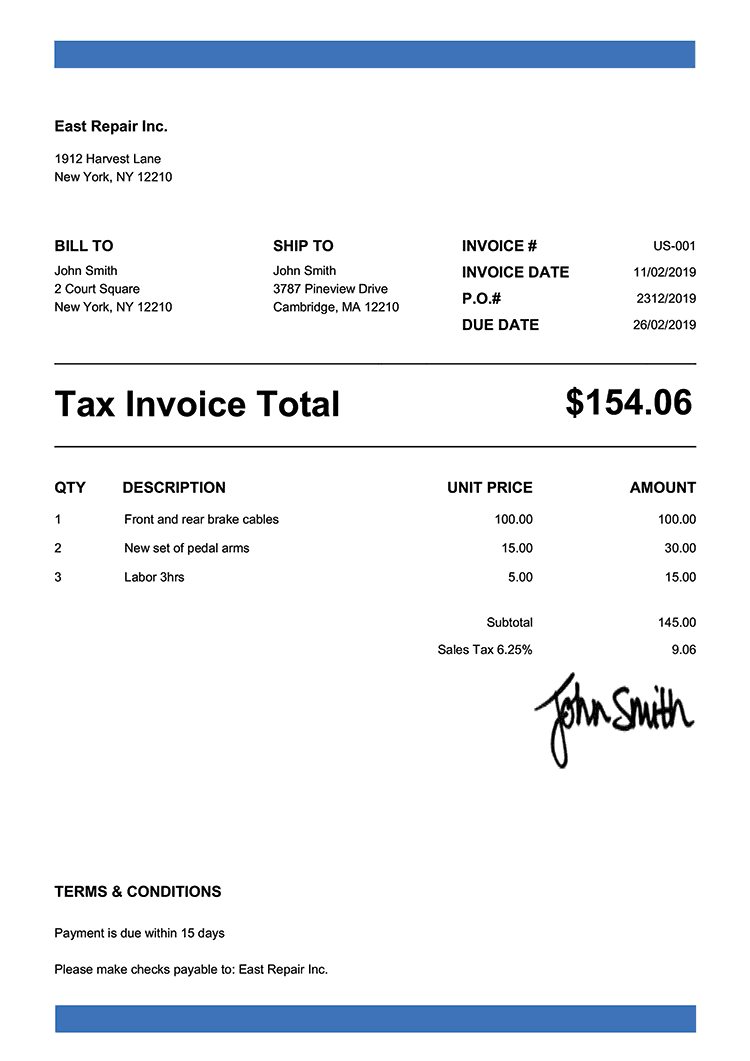

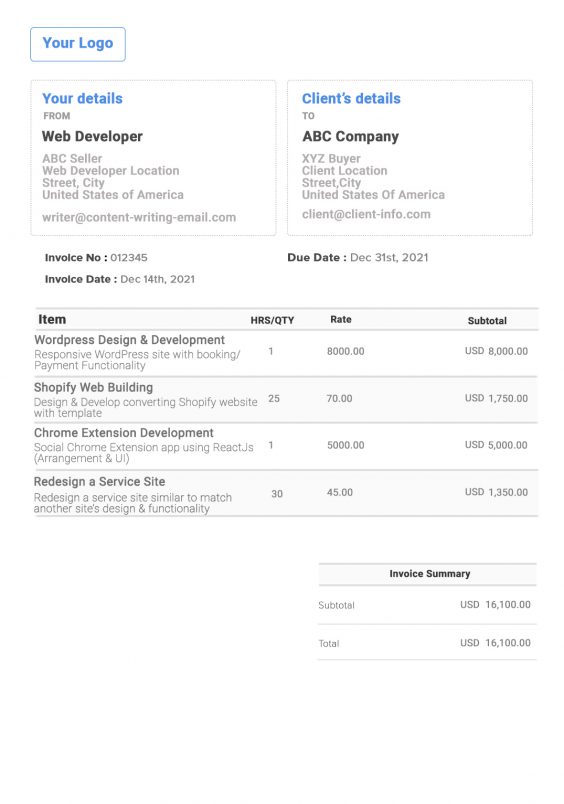

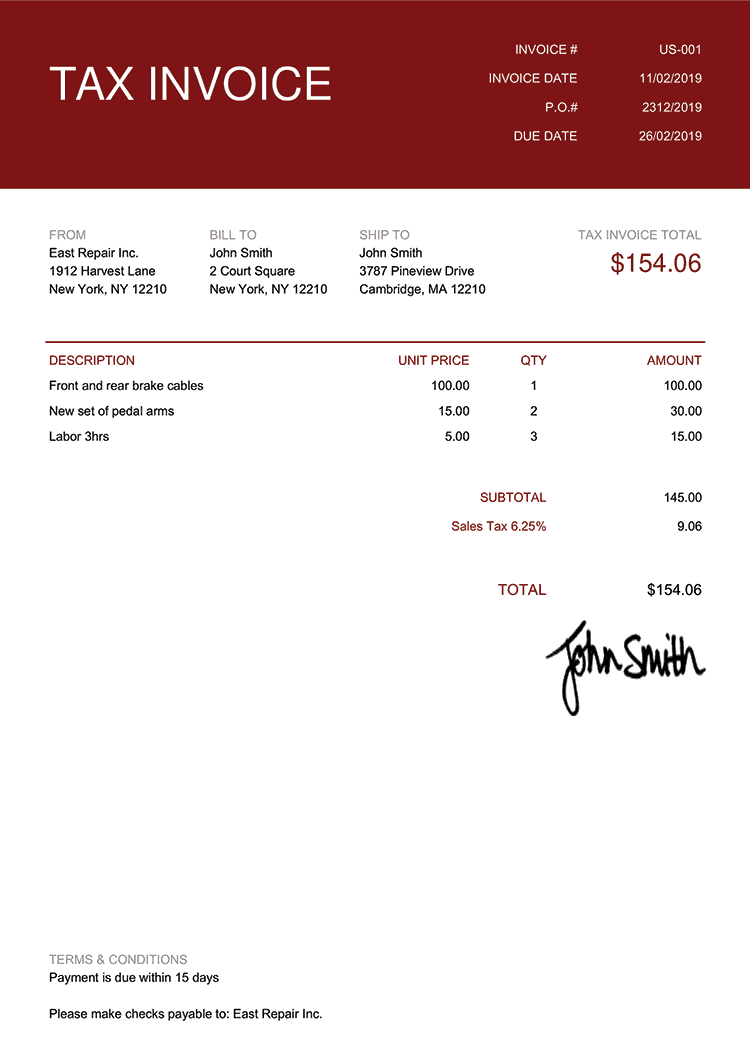

A typical tax invoice also an e-invoice with all the 16 mandatory fields under GST will look like this. These depend on various. John can also claim an amount that reflects the decline in value of the photocopier on his tax return.

You can edit any field and drag and drop invoice lines to reorder them. Enter the right GST amount. The Goods and Services Tax GST collected in Chandigarh for the month of October 2021 is Rs158 crores.

Once GSTR 1 is filed invoices are sent to registered email ids captured from SSR AI GST portal and also uploaded on AI portal for download upto one year from the date of invoice. In the Business menu select Invoices. If you live in a region where Shopify is required to charge taxes on any of your account charges these charges appear in your Shopify invoice.

GST Council may notify about. If your store is located in India then as of December 15 2021 you are charged the. GST is levied at all stages right from manufacturer up to the retailer who sells the goods for final consumption.

GST Compensation Cess is also applicable on reverse charge. Effective from April 1 2022 Indias nodal body for administering indirect taxes CBIC Central Board of Indirect Taxes and Customs had reduced the turnover limit for mandatory issuance of e-invoice electronic invoice under the goods and services Tax GST to INR 200 million US264 million from the earlier prescribed limit of INR 500 million US66. The name or trade name and GST number of the seller.

The GST tax slabs are. GSTIN or other information can be entered only at the time of the initial booking before the PNR is generated. Click the menu icon then select Edit.

Make a new invoice or bill payment or cash refund on a credit note. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. This helps in claiming the input tax credit.

Taxable and non-taxable sales. GST charged in India. What every tax invoice must show.

The date of issue. FREE for 1st year in India refer pricing for other countries such as India Australia Malaysia Nepal Pakistan. Send to send it to the customer.

When billing customers a tax invoice must be issued when the customer is a GST registered entity so that the latter can use it as a supporting document to claim input tax on the standard-rated purchases. Tax invoices are mandatory for claiming. Make your changes to the invoice.

UK Invoice Template no VAT. Customers are the ultimate bearer of the taxes and there is no cascading of tax as tax payable at each stage is available for set-off. To delete the payment edit the transaction and reapply the payment.

Either click Update or click the arrow icon and select. Up-to-date guide on Singapore Goods and Services Tax GST Tax also known as Value Added Tax VAT in many other countries. Print PDF to print the invoice.

Enter the GSTIN mentioned on the invoice in the search box and followed by captcha Final click enter to view the details. Tax invoices must be in New Zealand currency. Penalty 100 of the tax due or Rs.

Income Tax Calculator for AY 2023-24 FY 2022-23 AY 2022-23 FY 2021-22 AY 2021-22 FY 2020-21 to use for tax computation and to compare old vs new tax regime scheme for IT or Investment declaration with your employer. Enter the billing information and make invoices that you can print download as PDF or email to your customer. According to IRAS you should issue a tax invoice within 30 days of supplying goods.

You must send a tax invoice to your GST-registered customers. Now there are different types of invoices that are issued under the GST law. The fees and charges recovered for Special Service Request SSR such as excess baggage cancellation modification etc are inclusive of GST at the applicable rate.

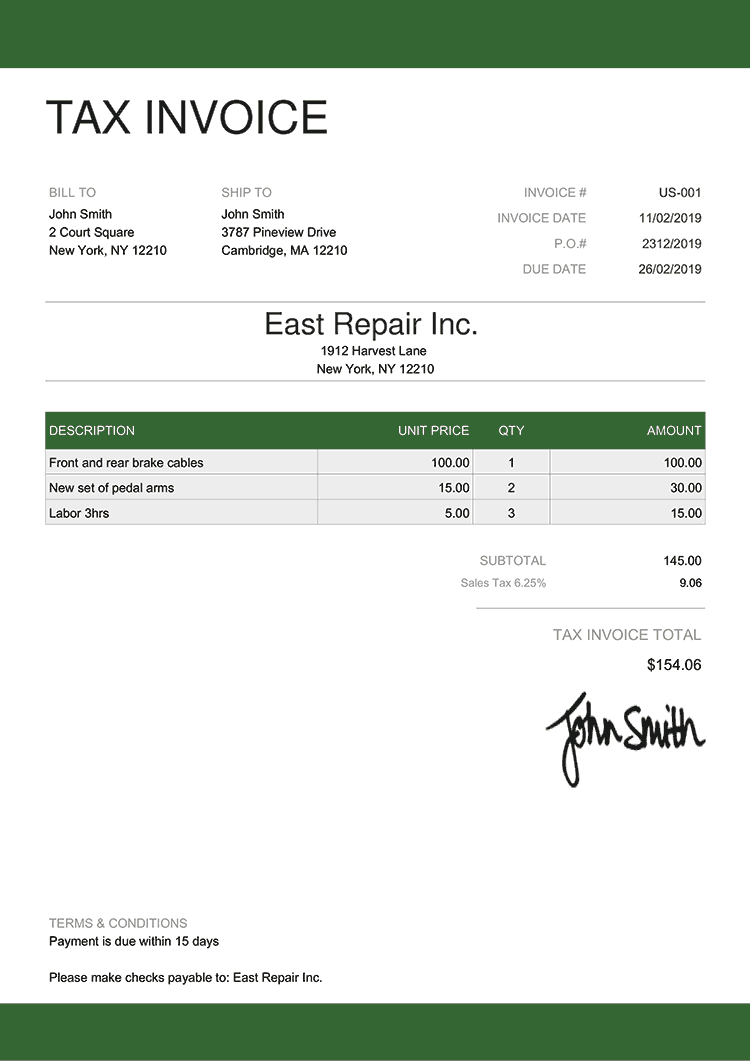

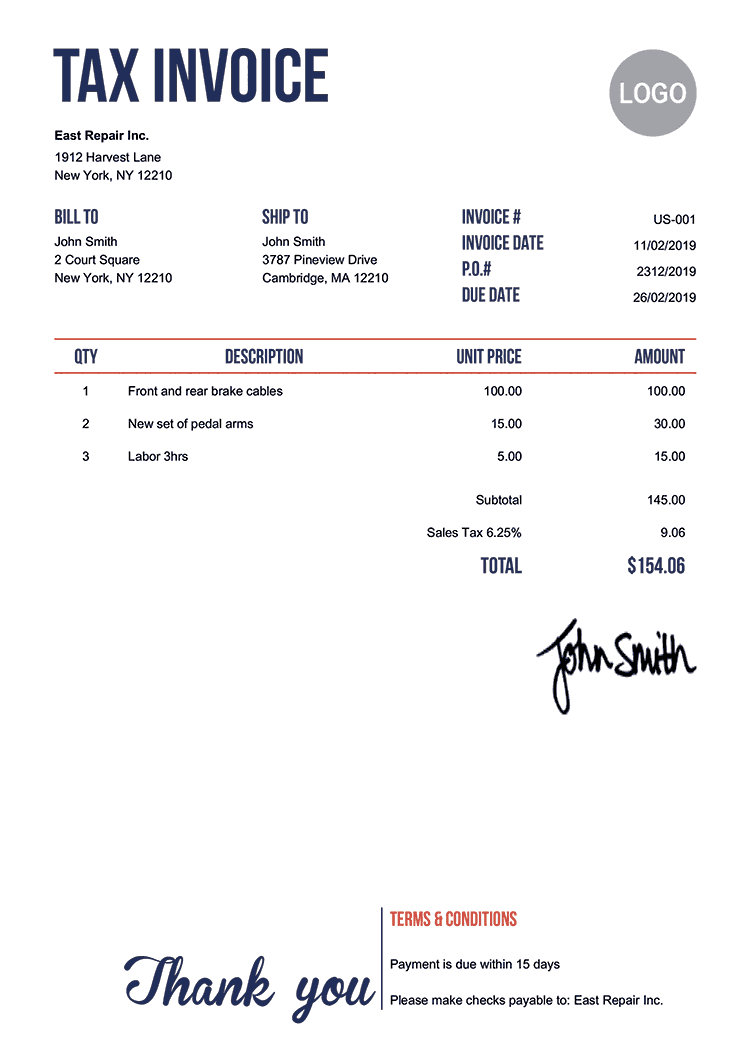

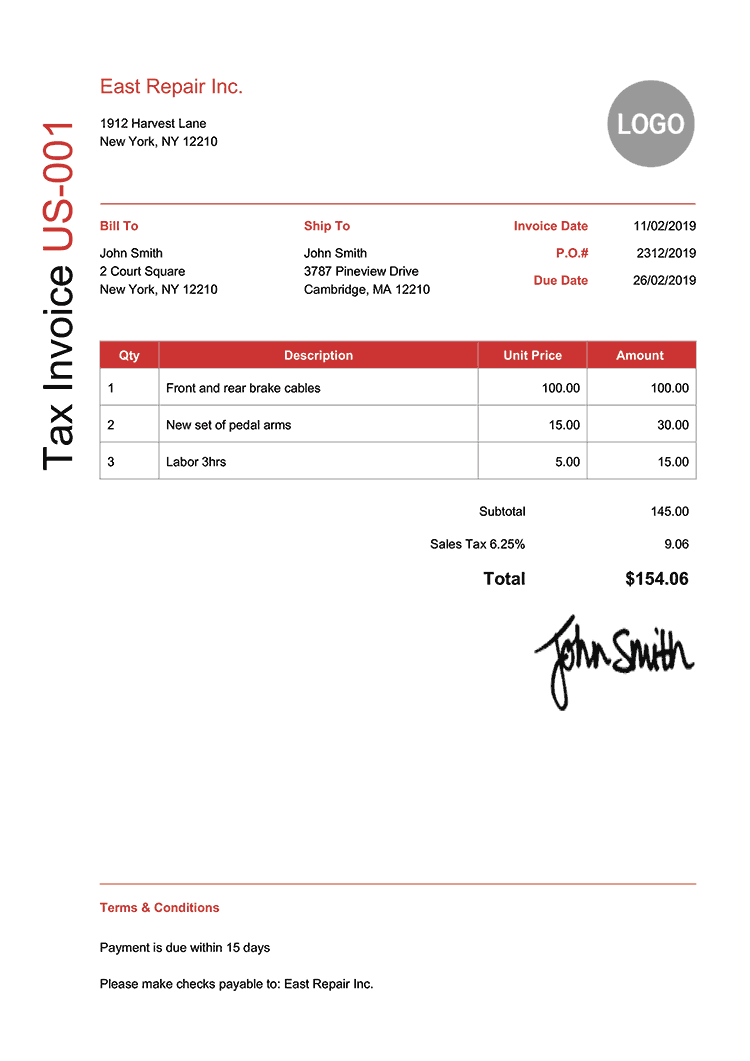

The words tax invoice in a prominent place. Depending on the total price of the tax invoice and how you sell your products or services there may be more requirements. Australian Invoice Template no GST.

Sales and Service Tax SST in Malaysia. Tax invoices sets out the information requirements for a tax invoice in more detail. The seller is registered for GST and charges John 1100 including 100 GST.

Penalty for not registering under GST. GSTR 20131 Goods and services tax. A tax invoice is the invoice created by a GST registered business owner when he sells taxable goods and services.

Including Malaysia Singapore and Hong. A tax invoice can only be issued once. What are the GST tax slabs.

Penalty 100 of the tax due or Rs. 10000 -whichever is higher if the additional GST collected is not submitted with the govt Penalty for not issuing an invoice. The GST law makes it necessary for registered taxpayers to issue invoices for the sale of goods or services.

A tax invoice is a document that records the purchase of goods or services from a company. Australian GST Tax Invoice Template. Format of GST Invoice.

The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018. It is requested to register on AI GST portal and upload ticket details within due date to get the invoices. Translation Service Invoice Template.

The number of digits of HSN code for goods or the accounting code for services and the various classes of registered persons should be mentioned. Find and open the invoice. 10000 whichever is higher.

Tax invoice will be issued to the email address specified by you. 3 Know what to include in a tax invoice A tax invoice must include the following 7 pieces of information to be valid. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come.

Remove and redo the payment. Heres all you need to know about tax invoices in Singapore. This years collection is 4 higher than the revenue collected during the same period last year.

Free GST Free Invoice Generator to help you create invoices in an instant. This is because the tax invoice not only enables the seller to collect payments but also avail input tax credit under GST regime. Uploading of ticket details is not mandatory.

A description of the goods or services. 10000 whichever is higher.

Tax Invoice Templates Quickly Create Free Tax Invoices

Travel Agency Invoice Format Excel Invoice Format Invoice Template Invoice Format In Excel

Tax Invoice Templates Quickly Create Free Tax Invoices

Hotel Invoice Template Print Result Invoice Template Word Receipt Template Invoice Template

Free 18 Customisable Tax Invoice Templates In Google Docs Google Sheets Excel Ms Word Numbers Pages

Flipkart Seller Hub Integration With Gst Accounting Software Eztax Accounting Software Accounting Create Invoice

Tax Invoice Templates Quickly Create Free Tax Invoices

Format Of Tax Invoice Under Gst Regime For Local State Taxable Supply Of Goods Invoice Format In Excel Invoice Format Computers For Sale

South Africa Tax Invoice Template Service Invoice Template Invoice Template Word Invoice Format In Excel

Tax Invoice Templates Quickly Create Free Tax Invoices

Tax Transaction Listing Web Based Online Accounting Software Malaysia Online Acc Online Accounting Software Accounting Software Small And Medium Businesses

Tax Invoice Templates Quickly Create Free Tax Invoices

How To Issue Tax Invoice Agoda Partner Hub

Web Dev Invoice Template Free Invoice Generator

44 Tax And Non Tax Invoice Templates Invoices Ready Made Office Templates Invoice Template Invoice Template Word Invoice Design

Free 18 Customisable Tax Invoice Templates In Google Docs Google Sheets Excel Ms Word Numbers Pages

Tax Invoice Templates Quickly Create Free Tax Invoices

Gst Malaysia Full Tax Invoice Gst Malaysia Full Tax Invoic Flickr

Invoice Bill Sample Copy For Hotels Front Office Invoice Sample Invoice Template Word Invoice Template